Keeping records for business – what you need to know

We all need to keep financial records for various reasons. If you fill in a tax return, VAT return or claim benefits or tax credits, there are some special rules.

Here we tell you about:

• how keeping accurate records helps you

• why you need to keep records

• the records you need to keep

• how to keep your records

• how long you need to keep your records

• getting things right from the start

• simple record keeping applications for mobile devices

• where to get more information.

Keeping accurate records helps you

Having an accurate record keeping system which you keep up to date will help you:

• pay the right amount of tax

• avoid paying any extra tax or penalties

• keep track of your expenses

• see quickly what you are owed by others and how much you owe them

• ask for a bank loan or credit if you need to

• save time and accountancy costs

• receive the right amount of benefits or credits.

Why you need to keep records

If you have to fill in and send us a tax return, the law says that you should keep all

the records and documents you need to enter the right figures. If we need to check

your return, we may ask to see the records you used to complete it.

Record keeping penalties

If you do not keep adequate records or you do not keep your records for the

required period of time, you may have to pay a penalty.

Penalties for an inaccurate return

If you send us an inaccurate return you may have to pay a penalty. Complete, readable

and accurate records will help you fill in your return correctly and so help you to avoid

this penalty.

However, people do make mistakes. You will not have to pay a penalty if you can

show us that you took reasonable care to get your return right but still made a

mistake. Some of the ways in which you can show you’ve taken reasonable

care include:

• keeping full and accurate records which are regularly updated and saved securely

• checking with HMRC or an agent or accountant if there is something that you

don’t understand.

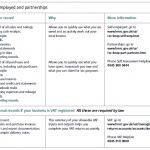

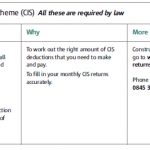

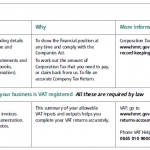

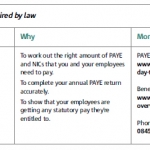

The records you need to keep

The sort of records you need to keep depends upon the type of tax you have

to pay. To find out what records you should be keeping, go to

www.hmrc.gov.uk/record-keeping/index.htm

At the end of this factsheet there are tables which give examples of the most

common records.

How to keep your records

The law does not say how you must keep your records. You need to keep some

original documents which show that tax has been deducted. An example is form

P60 End of Year Certificate for PAYE. We recommend that you keep all original

documents you receive.

Most records can be kept electronically (on a computer or any storage device such

as disk, CD, memory stick or microfilm) as long as the method you use:

• captures all the information on the document (front and back), and

• allows the information to be presented to us in a readable format, if we need to

see it.

How long you need to keep your records

As a general rule, you should keep your records for a minimum of six years. However,

if you are:

• an employer, you need to keep Pay As You Earn (PAYE) records for three years

(in addition to your current year)

• a contractor in the Construction Industry Scheme (CIS), you need to keep your CIS

records for three years (in addition to your current year)

• keeping records to complete a personal (non-business) tax return, you only need

to keep them for 22 months from the end of the tax year to which they relate.

If you need to keep records for other reasons, for example, the Companies’ Act

requires limited companies to keep specific records and you also use those records

for tax purposes, you need to be aware that there may be different time limits for

retaining them. Be careful not to destroy any records you also use for tax purposes

too soon.